U.S. Stock Futures Surge: U.S. Stock Futures Surge as Wall Street Bets Big on Thanksgiving Week and Holiday Sales – in simple terms, markets are saying, “If the shopper shows up, the rally stays alive.” Futures tied to the Dow Jones Industrial Average , S&P 500 , and Nasdaq‑100 are all pointing higher as traders lean into one of the most important shopping weeks of the year. Think of stock futures as the market’s early‑morning forecast. When they’re green going into Thanksgiving week, investors are betting that strong Black Friday, Cyber Monday, and holiday sales will help support corporate profits and keep recession fears at bay. Add in growing hopes that the Federal Reserve may be done hiking rates – and might even cut in 2026 – and you get a holiday‑flavored cocktail of optimism, caution, and FOMO.

U.S. Stock Futures Surge

U.S. stock futures are rallying into Thanksgiving week because Wall Street is betting the American shopper will show up in force, with record holiday spending and moderating inflation keeping hopes alive. NRF’s forecast of holiday sales topping one trillion dollars for the first time adds weight to bullish sentiment, backed by the historical positive seasonal trends during Thanksgiving and the Santa Claus rally. Yet, risks remain, and no seasonal effect offers a sure bet. Investors should let this data inform decisions without letting hype override careful planning. Whether you’re a beginner or a professional, the smartest move is a balance: respect the numbers, manage risks, and keep focus on the long-term journey.

| Point | Details |

|---|---|

| Article focus | Why U.S. stock futures are surging into Thanksgiving week and what the holiday shopping season means for everyday and professional investors. |

| Latest futures move | Dow futures up around 0.3%, S&P 500 futures up ~0.5–0.6%, Nasdaq‑100 futures up ~0.7–0.8% heading into the week. |

| Recent market backdrop | S&P 500 is down about 3.5% so far in November; last week the S&P 500 and Dow each fell around 1.9%, Nasdaq about 2.7%, reflecting recent volatility. |

| Holiday sales scale | 2024 U.S. holiday retail sales reached roughly 976–994 billion, up about 4% year over year, setting another record. |

| 2025 forecast | NRF projects 2025 holiday sales to top 1 trillion for the first time, with 3.7–4.2% growth over 2024. |

| Black Friday online spend | U.S. shoppers spent about 10.8 billion online on Black Friday 2024, up roughly 10.2% year over year. |

| Online vs. in‑store | Mastercard SpendingPulse shows Black Friday 2024 online sales up ~14.6%, in‑store up around 0.7%. |

| Seasonality edge | Since 1961, the S&P 500 has finished Thanksgiving week higher roughly 75% of the time, with a median weekly gain near 0.75%. |

| Santa Claus rally | From 1950–2020, the S&P 500’s average return during the classic Santa Claus rally window is about 1.3%. |

| Trading schedule | U.S. stock market is closed on Thanksgiving Day and runs a shortened session on Black Friday; official calendar at nyse.com. |

What Are U.S. Stock Futures, in Plain English?

Imagine the market posts a “coming soon” price tag before the store opens – that’s roughly what futures are. Futures on big indexes like the Dow, S&P 500, and Nasdaq‑100 trade almost around the clock and show where investors think the market will open once the bell rings.

When those futures jump ahead of a big week like Thanksgiving, it means traders are willing to put real money behind the idea that good news is coming – better‑than‑feared holiday sales, decent earnings, and maybe friendlier central‑bank policy over the next year.

Stock futures are popular among institutional investors, hedge funds, and active traders who want to position themselves overnight or over the weekend when the stock market is closed. Retail investors can watch futures to get a sense of market sentiment but cannot trade them directly as easily.

Why Thanksgiving Week Is a Big Deal for Wall Street?

Thanksgiving week is more than turkey, football, and family drama. It’s also the unofficial starting gun for the U.S. holiday shopping season. Black Friday, Small Business Saturday, and Cyber Monday together set the tone for how November–December might play out for retailers.

At the same time, it’s a condensed trading week: U.S. stock markets are closed Thursday for Thanksgiving and run a shortened session Friday, typically closing early in the afternoon. Because many big players are out, trading volumes are lighter and price swings can look larger – which means the moves you see on screen may be exaggerated compared with a normal week.

This shorter week also means investors and traders want to be extra cautious. Positions might be trimmed ahead of the long weekend, or alternatively, some traders go all-in hoping for a quick jump on strong data. That creates a dynamic environment that can swing markets.

The Market Backdrop: Volatile but Hopeful

This futures surge isn’t happening in a vacuum. Recent data show:

- The S&P 500 has dropped about 3.5% in November, on track for its toughest month since March, amid worries about stretched valuations and AI‑stock fatigue.

- Last week alone, the S&P 500 and Dow each fell around 1.9%, while the Nasdaq slid roughly 2.7%.

So part of this move in futures is simple “buyers showing up after a pullback.” Another part is traders betting that strong holiday spending plus easing inflation can keep the soft‑landing narrative alive into year‑end.

Volatility is a reminder that expectations can shift fast. Bad earnings reports or higher rates news could quickly send futures back down. But for now, traders seem comfortable poking their heads in while waiting for more clarity.

Holiday Sales by the Numbers: Why Wall Street Cares

For both Main Street and Wall Street, the holidays are the Super Bowl of shopping.

Some key stats:

- The National Retail Federation reports 2024 U.S. holiday retail sales (Nov–Dec) rose about 4.3% from 2023 to reach roughly 976.1 billion–mid‑990s billions, a new record.

- For 2025, NRF forecasts 3.7–4.2% growth, expecting total holiday sales between 1.01 and 1.02 trillion – the first time ever above 1 trillion.

- NRF also expects retailers to hire 265,000–365,000 seasonal workers in 2025, down from 442,000 in 2024, partly because more work is being done earlier and online.

This spending strength is important because retail accounts for roughly 20% of U.S. GDP. When shoppers open their wallets during the holidays, it signals broader consumer health. Strong consumer spending fuels corporate earnings, supports jobs, and helps avoid economic slowdowns.

For a 10‑year‑old: Americans are still shopping big during the holidays. For a pro: consumer resilience, wage growth outpacing inflation, and “wealth effects” from higher asset prices are still supporting spending.

Black Friday & Cyber Monday: Real‑Time Market Fuel

Black Friday is no longer just people lining up at 5 a.m. for TVs – it’s a massive data event.

Highlights from 2024:

- U.S. online shoppers spent about 10.8 billion on Black Friday, up roughly 10.2% versus the prior year.

- Mastercard SpendingPulse estimates Black Friday retail sales (excluding autos) up around 3.4%, with online up ~14.6% and in‑store up ~0.7%.

- Global Black Friday online sales reached an estimated 74.4 billion, with mid-single to high-single-digit percentage growth.

For investors, that tilt toward digital tells a clear story: e‑commerce, logistics, and payments platforms keep gaining ground, while traditional retail must innovate to keep up.

The strength of online sales signals consumers’ growing preference for convenience and speed, which benefits major online retailers like Amazon , as well as logistics firms like UPS and FedEx .

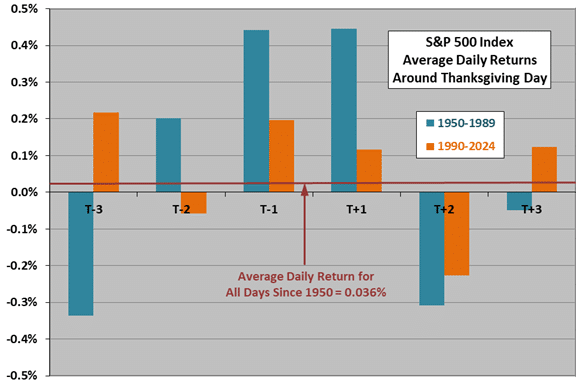

Seasonality: Why Thanksgiving Week Is Often Bullish

If you hang around market folks, you’ll hear phrases like “holiday effect” and “Santa Claus rally.”

Data backs up some of that lore:

- Since 1961, the S&P 500 has finished Thanksgiving week positive about three‑quarters of the time, with median gains near 0.75%.

- One study found Thanksgiving week’s average return for the S&P 500 around 0.60–0.70%, better than a random week.

- Research on holiday seasonality shows markets often see better-than-average returns in the days just before and after long weekends.

Of course, there are nasty exceptions (2011 was a downer, 2008 was wild), but historically this is one of the more favorable weeks of the year.

Seasonal effects are self-reinforcing to some degree: as more traders expect a holiday rally, their buying contributes to the upward momentum. However, this doesn’t guarantee profits, and other factors like earnings and macroeconomic news often dominate.

The Santa Claus Rally: The Next Chapter After Thanksgiving

Thanksgiving week is often just the opening act.

The classic Santa Claus rally refers to the last five trading days of the year plus the first two of the new year:

- From 1950–2020, the S&P 500 has averaged about 1.3% gains over this seven-trading-day window.

- Historical analysis suggests positive returns roughly 75–80% of the time for the S&P 500, Dow, and even higher for some growth-oriented indexes.

While the Santa Claus rally has become a staple expectation for many investors, it’s important to remember that no seasonal trend is guaranteed. Unforeseen geopolitical events or economic shocks can derail even the most reliable patterns.

U.S. Stock Futures Surge: How Everyday Investors Can Navigate Thanksgiving Week

1. Know the Trading Schedule

- Check the official NYSE holiday calendar at nyse.com for exact hours.

- Remember: markets are closed Thursday and close early Friday, so liquidity is thinner and price swings can be sharper.

2. Focus on Data, Not Just Headlines

Instead of chasing viral videos of packed malls:

- Follow NRF updates for official holiday forecasts and recaps.

- Watch U.S. Census Bureau retail sales for confirmed monthly numbers.

- Track Adobe Analytics and Mastercard SpendingPulse for timely Black Friday and Cyber Monday data.

3. Watch the Big Holiday Themes

Professionals often build watchlists around:

- Retail and e-commerce – companies exposed to holiday traffic and online spend.

- Logistics and delivery – firms benefiting from surge in shipments.

- Payments and Buy Now Pay Later (BNPL) – as consumers increasingly use cards and installment plans.

Rather than chasing every hype, pros focus on actual sales vs. expectations to find trade opportunities.

4. Check Your Risk Before You Get Cute

Holiday optimism can tempt people to overtrade. Ask:

- If the market drops 5–10%, will this position blow up my plan?

- Am I overconcentrated in one volatile theme like AI or e-commerce?

Even seasoned traders size down or hedge around big event weeks.