Social Security Benefits: If you’re wondering about your Social Security benefits in December 2025, you’re not alone. Every year, the Social Security Administration (SSA) tweaks the payment schedule to account for holidays, and this December is no different. Whether you’re getting Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI), knowing when your money hits your account can help you plan your budget and avoid any surprises. In this article, we’ll break down the December 2025 deposit schedule, give you the inside scoop on what to expect, and offer practical tips to make sure you’re ready for the holidays.

Social Security Benefits

December 2025 is a unique month for Social Security beneficiaries, especially those on SSI. With two SSI payments and the usual SSDI schedule, it’s a great time to plan your finances and make the most of your benefits. Remember to check your bank account, update your info with the SSA, and watch out for scams.

| Benefit Type | Payment Date(s) | Special Notes |

|---|---|---|

| SSI | December 1, December 31 | Early January payment due to New Year’s holiday |

| SSDI/Retirement | Dec 10, 17, 24 | Based on birth date; see table below |

| Early Payment | December 31 | Includes 2026 COLA increase for SSI |

| Official Source | ssa.gov/pubs/calendar.htm | Always check for updates |

What’s New in December 2025?

December 2025 is a bit special for Social Security recipients. Because New Year’s Day (January 1, 2026) falls on a Thursday, the SSA is shifting the January SSI payment to December 31, 2025. This means eligible SSI recipients will get two payments in December: one on the 1st (regular) and one on the 31st (early January). This is a big deal if you rely on SSI to cover your bills, so mark your calendar and plan accordingly.

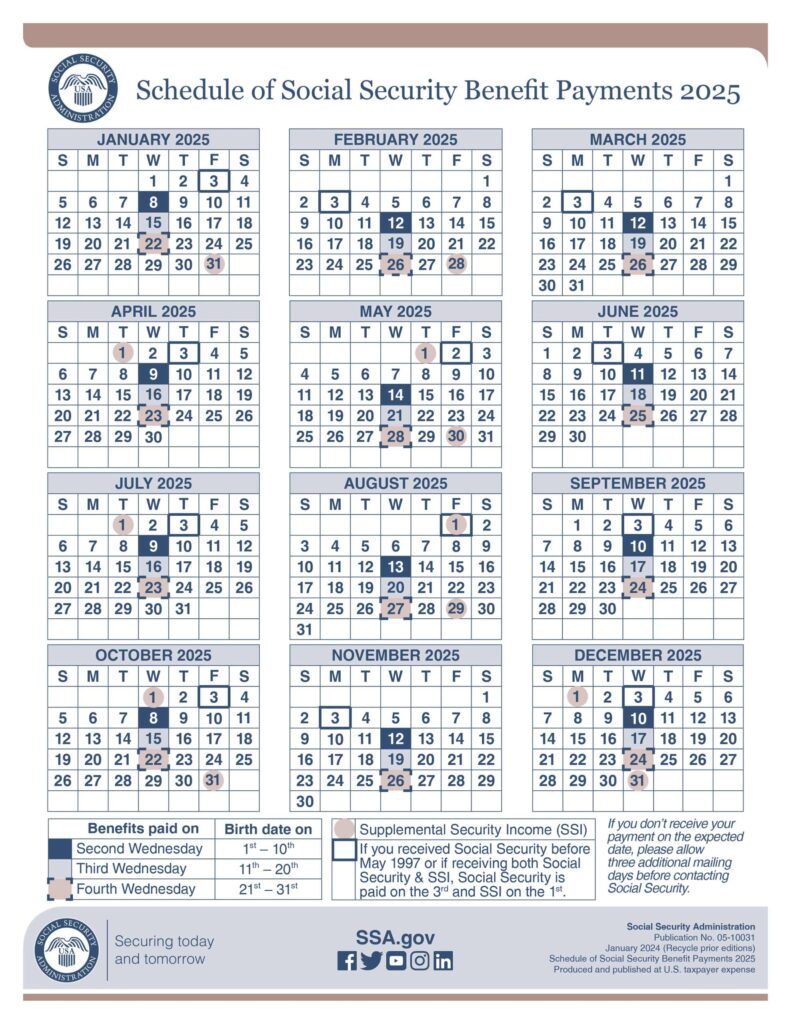

For SSDI and regular Social Security retirement benefits, the payment dates follow the usual pattern based on your birth date:

- Birthdays 1–10: Payment on December 10 (second Wednesday)

- Birthdays 11–20: Payment on December 17 (third Wednesday)

- Birthdays 21–31: Payment on December 24 (fourth Wednesday)

If you receive both SSI and SSDI, you could see three deposits this month: your regular SSI, your regular SSDI, and the early January SSI payment.

How the Social Security Benefits Schedule Works?

The Social Security payment schedule is designed to keep things smooth for everyone, especially around holidays. Here’s a quick breakdown:

SSI Payments

- Regular Payment: December 1, 2025

- Early Payment: December 31, 2025 (for January 2026)

- No Payment in January 2026: Because it’s paid early in December

SSI payments are usually made on the 1st of the month. When the 1st falls on a weekend or holiday, payments are made on the last business day before. This year, because New Year’s Day is a federal holiday, the January payment is moved to December 31.

SSDI and Retirement Payments

SSDI and retirement benefits are paid on Wednesdays, based on your birthday:

- 1st–10th: Second Wednesday (December 10)

- 11th–20th: Third Wednesday (December 17)

- 21st–31st: Fourth Wednesday (December 24)

If you started getting benefits before May 1997, or if you receive both SSI and SSDI, your Social Security payment will be on the third Wednesday of the month (December 17), and your SSI will be on the 1st and 31st.

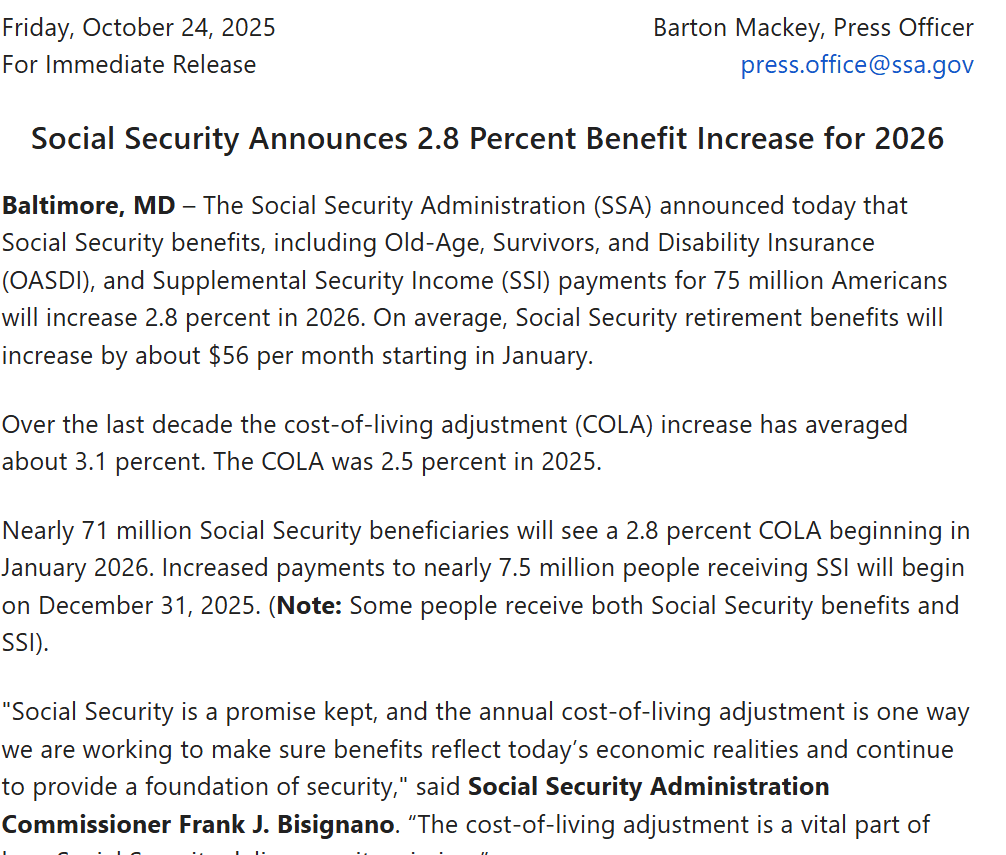

Cost-of-Living Adjustment (COLA) 2025 and 2026

In 2025, Social Security and SSI beneficiaries received a 2.5% COLA increase, raising the average monthly payment for retirees to about $1,976. The December 31 SSI payment will include the 2026 COLA increase of 2.8%, so recipients will see a bigger bump in their January benefits. This means your payment on December 31 will be slightly higher than your December 1 payment.

Payment Methods: Direct Deposit vs. Paper Checks

Most people now receive their Social Security payments via direct deposit, which is faster, safer, and more reliable than paper checks. With direct deposit, your money lands in your bank account automatically, and there’s no risk of lost or stolen checks. Paper checks, on the other hand, can be lost in the mail or stolen, and you have to physically deposit them to access your funds. If you’re still using paper checks, consider switching to direct deposit for added security and convenience.

How to Avoid Social Security Benefits Scams?

Scammers love to target Social Security recipients, especially around holidays. Here’s how to protect yourself:

- Never give your Social Security number or bank info over the phone or online unless you initiated the contact through official channels.

- Hang up on suspicious calls or texts, and report them to the SSA or FTC.

- Do not send money via gift cards, wire transfers, or cryptocurrency. The SSA will never ask for payment this way.

- Freeze your credit if you suspect identity theft.

- Spread the word to friends and family, especially seniors, who are common targets.

Who Qualifies for Social Security Benefits?

To be eligible for Social Security retirement or disability benefits, you generally need to have earned enough Social Security credits. In 2025, you earn one credit for every $1,810 in covered earnings, up to a maximum of four credits per year. The number of credits required depends on your age:

- Under 24: 6 credits in the 3-year period before disability begins.

- Ages 24–31: Half the time between age 21 and the start of disability.

- Ages 31–62: The number of credits increases with age, up to 40 credits (about 10 years of work) for those aged 62 and older.

For SSI, eligibility is based on financial need, not work history. You must be aged 65 or older, blind, or disabled, and meet strict income and resource limits. The maximum monthly SSI payment for an individual in 2025 is $943, and for a couple, it’s $1,415.

How to Apply for Social Security Benefits?

Applying for Social Security benefits is easier than ever, thanks to online tools. Here’s a step-by-step guide:

- Check Eligibility: Confirm you meet the requirements for retirement, disability, or SSI.

- Gather Documents: You’ll need your Social Security number, birth certificate, proof of citizenship, W-2 forms, and bank account details for direct deposit.

- Apply Online: Visit the SSA website, log in to your “my Social Security” account, and fill out the application.

- Submit Application: Review your information, submit, and keep copies for your records.

- Wait for Decision: The SSA will review your application and send a decision letter by mail.

Processing can take up to six weeks, so apply early to avoid delays. You can also apply by phone or in person at a local SSA office.

How Are Social Security Benefits Calculated?

Your Social Security benefit is based on your average indexed monthly earnings (AIME) from your 35 highest-earning years, adjusted for inflation. The SSA uses a formula called the Primary Insurance Amount (PIA) to determine your monthly payment:

- 90% of the first $1,226 of AIME

- 32% of AIME between $1,226 and $7,391

- 15% of AIME above $7,391

For example, if your AIME is $6,000, your PIA would be about $2,236 per month. The maximum monthly payment for retirees in 2025 is $4,018. You can use the SSA’s online benefit calculator to estimate your own payment.

SNAP benefits Payment Date in December 2025; Check Payment Amount & State Wise Eligibility

$550K Mistake Still Haunts Richmond: Retirement System Keeps Paying Dead Retirees, Audit Reveals

U.S. Stock Futures Surge as Wall Street Bets Big on Thanksgiving Week and Holiday Sales