Will She Still Get a Federal Pension? Rep. Marjorie Taylor Greene’s announcement that she’ll be stepping down from Congress soon has sparked a lot of conversations, debates, and questions, especially about whether she’ll still collect a federal pension despite quitting early. Pensions aren’t just about sitting back and cashing checks — they’re a complex part of federal employment benefits packed with rules, timing, and long-term planning. So, what’s the deal with Greene’s pension? This article unpacks federal pensions for members of Congress in simple terms, explores Greene’s situation with fresh insights, and provides practical advice for anyone curious about public service retirement benefits. Whether you’re a political follower, a federal employee, or someone interested in retirement planning, this detailed guide will help you understand the ins and outs of congressional pensions, why timing matters, and how Greene’s move fits into the bigger picture.

Will She Still Get a Federal Pension?

Marjorie Taylor Greene’s resignation offers a practical example of federal pension rules at work. By timing her resignation to just surpass the five-year service mark, she secures eligibility for a modest but guaranteed pension beginning at age 62. This story highlights the importance of understanding federal retirement systems—not just for members of Congress but for all federal employees. These pensions provide crucial financial support after retirement but come with strict eligibility rules and require strategic planning. For anyone working in public service, knowing your pension facts today makes a big difference in securing a comfortable tomorrow.

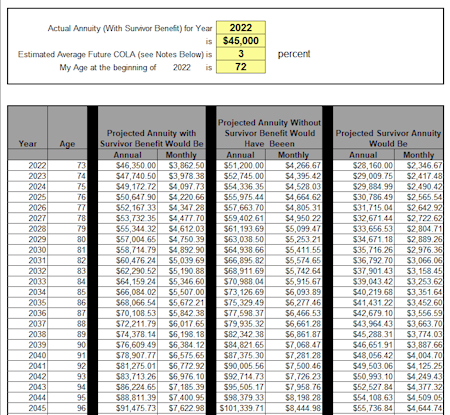

| Topic | Details |

|---|---|

| Greene’s Resignation Date | January 5, 2026 |

| Pension Minimum Service Requirement | 5 years |

| Greene’s Total Service | Just over 5 years |

| Pension Eligibility Starting Age | 62 years |

| Estimated Annual Pension | Around $8,700 |

| Pension Formula | High-3 Salary × 1.7% × years (up to 20 years) |

| FERS Components | Basic annuity, Social Security, Thrift Savings Plan (TSP) |

| Reliable Source for Rules | US Office of Personnel Management |

What Is a Federal Pension and How Does It Work?

Federal pensions under the Federal Employees Retirement System (FERS) are available to most federal employees hired after 1984, including members of Congress. This system is made up of three parts:

- Basic Annuity: A monthly pension based on your salary and how long you worked.

- Social Security Benefits: As federal employees, members also contribute to and receive Social Security.

- Thrift Savings Plan (TSP): A retirement savings plan similar to a 401(k), where both employees and the government contribute.

The combination of these three components offers a retirement income source designed for long-term financial security, but it doesn’t work unless you meet certain rules.

Who Is Eligible for a Congressional Pension?

Eligibility for congressional pensions depends primarily on how many years you serve in Congress and your age at retirement or resignation. The basic rules under FERS are:

- Serve at least five years to be eligible for retirement benefits.

- Eligible for full pension at age 62 with 5 years of service.

- Eligible for pension at age 50 with 20 years of service.

- Eligible to retire at any age after 25 years of service.

Marjorie Taylor Greene started her term on January 3, 2021. By planning her resignation effective January 5, 2026, she just crosses that five-year service threshold, which means she qualifies for a pension once she hits age 62.

How Is the Pension Amount Determined?

Calculating a congressional pension involves a few variables:

- High-3 Salary: Average of your highest three years’ salaries.

- Years of Service: Total years you served in Congress.

- Accrual Rate: A percentage applied to your years of service that determines how much of your salary you get annually.

For new members under FERS like Greene, the formula is:Annual Pension=(High-3 Salary×1.7%×Years served, up to 20)+(High-3 Salary×1.0%×Years over 20)\text{Annual Pension} = (\text{High-3 Salary} \times 1.7\% \times \text{Years served, up to 20}) + (\text{High-3 Salary} \times 1.0\% \times \text{Years over 20})Annual Pension=(High-3 Salary×1.7%×Years served, up to 20)+(High-3 Salary×1.0%×Years over 20)

Since Greene served just over five years, the calculation applies the 1.7% multiplier to those years. This results in a pension estimated at around $8,700 per year, a modest but steady income supplement after retirement.

The Significance of Timing: Why Greene’s Resignation Date Matters

The key controversy around Greene’s resignation centers on timing. If she had resigned just a few days earlier — before hitting five full years — she wouldn’t be eligible for any pension benefits. The pension cutoff is strictly at five years.

By waiting until January 5, 2026, she ensures she crosses the minimum threshold, allowing her to collect a lifetime pension starting at age 62.

Critics have slammed this as “gaming the system,” accusing Greene of making a financial decision to benefit personally while avoiding further political fallout. Supporters argue she is simply exercising her rights under the current law.

This situation sheds light on the importance of knowing pension rules and how retirement decisions affect your long-term financial security.

What Does a Federal Pension Cover?

Members of Congress receive several components in retirement:

- Basic Annuity: The fixed pension amount they calculated during retirement.

- Social Security: Members pay into and eventually collect Social Security separately.

- Thrift Savings Plan (TSP): A voluntary savings plan with government matching contributions.

Together, these provide a multi-layered retirement income. But it’s important to note that the pension alone usually isn’t enough to live on, especially in high-cost areas. Many rely on savings and other investments to fill the gap.

Will She Still Get a Federal Pension? Other Factors Affecting Greene’s Pension

Divorce and Pension Benefits

Marjorie Taylor Greene recently went through a divorce, which could impact how her pension or survivor benefits are handled. Divorce decrees often include provisions about pension division which can reduce benefits available to the member.

Effect of Pension Reform Debates

Federal pensions, particularly for Congress members, face ongoing scrutiny and calls for reform due to fairness concerns and budget impact. Greene’s situation highlights these debates—how much is enough, and who should qualify?

Comparing Congressional Pensions With Average Federal Employees

Congressional pensions tend to be higher than those for average federal workers because congressional salaries are typically higher. However, the basic eligibility rules and FERS framework remain the same for all federal employees.

Recent data shows:

- Median federal employee pension ranges between $25,000 and $40,000 annually based on years of service.

- Congressional pensions are calculated similarly but often yield higher payouts due to pay scale differences.

- Both face criticism regarding costs and calls for sustainability reforms.

Practical Advice for Federal Employees and Public Servants Planning Retirement

Planning federal retirement can feel overwhelming, but understanding these key points helps prepare you:

- Track Your Service Carefully

Know exactly how many years you have, especially nearing 5- or 20-year milestones. - Plan Your Retirement Age

Early retirement can reduce benefits, while waiting may increase your monthly pension. - Max Out Your TSP Contributions

Take advantage of government matches and catch-up contributions if you’re over 50. - Understand Your High-3 Salary

Career moves affecting your salary during peak years impact your pension. - Watch for Rule Changes

Federal pension rules can evolve, so stay updated with the U.S. Office of Personnel Management (OPM) at opm.gov.