45 Genius Money-Saving Hacks: Living solo in the U.S. means all the power and freedom, but also all the bills and expenses on your own. Managing money smartly when you live alone isn’t just about scrimping; it’s about finding hacks that save cash and time, while making life easier and more comfortable. Whether you’re a young buck starting out or a seasoned pro flying solo, these money-saving tips will help you stretch your dollar in 2025 and beyond. Living alone brings unique challenges: no splitting rent, utility bills, groceries, and you’re the sole cook and household manager. But it also means you have full control, allowing savvy money moves. Let’s dive into practical hacks, backed by data and real-life insights, that can help solo dwellers save big without feeling like they’re sacrificing quality of life.

45 Genius Money-Saving Hacks

Living alone in the U.S. offers independence but means owning your financial game. These 45 genius money-saving hacks are built for solo dwellers who want to keep their wallets healthy while living comfortably. By batching meals, managing utilities, tracking spending, and using resources like FDIC’s Money Smart, you can build a solid financial safety net and maybe even enjoy some guilt-free splurges. Remember, saving isn’t just about stretching every penny—it’s about empowering yourself to live well on your own terms. Start small, pick a few hacks, and you’ll find yourself wondering why you didn’t know these sooner!

| Topic | Details |

|---|---|

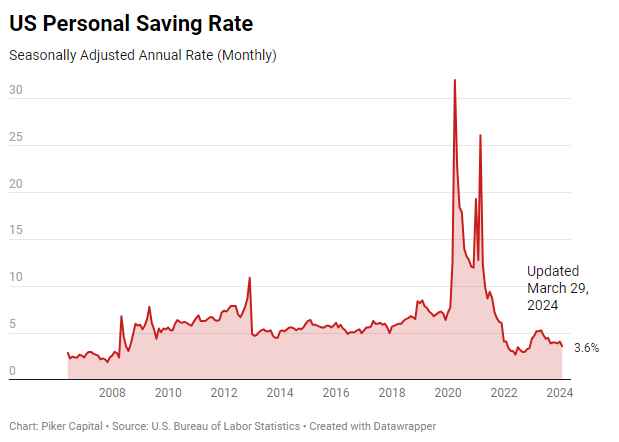

| Average U.S. personal saving rate | 4.4% of disposable income (2025 data) |

| Emergency savings coverage | 55% of adults have 3+ months of expenses saved |

| Popular money-saving hacks | Bulk cooking, curbside grocery pickup, energy-saving home tips, using coupons |

| Budget rule | 50-30-20 spending budget (needs, wants, savings) |

| Financial literacy resources | FDIC Money Smart and Better Money Habits (Bank of America) |

Why Living Alone Means You Need Smarter Money Moves?

Being the solo boss of your space means everything comes on your tab—from rent and utilities to food and internet. Unlike roommates who split expenses, you’re footing all bills solo, sometimes feeling like you’re burning cash fast. According to 2025 stats, personal saving rates in the U.S. hover around 4.4%, meaning many Americans struggle to save beyond daily expenses.

Good news? Most Americans (55%) do have an emergency fund covering three months’ living expenses, which is a lifesaver for unexpected costs like car repairs or medical bills. So adopting smart cost-cutting hacks is not just about penny-pinching but building financial resilience.

Additionally, living alone can increase financial anxiety since there’s no safety net from roommates or family. Having control over finances means crafting habits that empower you rather than stress you out. Your money choices directly affect your quality of life, so strategic saving allows more freedom and less worry.

45 Genius Money-Saving Hacks

1. Smarter Groceries: Cut Costs and Waste

- Order groceries online or use curbside pickup to avoid impulse buys—people report spending up to 50% less compared to in-store shopping.

- Buy bulk nonperishables like rice, beans, and frozen veggies when on sale; stock up strategically.

- Cook in large batches using affordable ingredients like beans and rice; portion out meals for the week and freeze extras.

- Freeze cut-up veggies and spinach bags to grab and steam instant meals.

- Brew your own coffee and bake bread at home to avoid daily café expenses. The savings add up quickly.

- Use apps that track prices and send deals and coupons straight to your phone. Combining coupons with sales maximizes savings.

- Plan meals around sale items; rotate weekly menus based on what’s cheapest and freshest.

2. Slash Utility Bills Like a Pro

- Close blinds and curtains during hot days to cut cooling costs by blocking sunlight, lowering indoor temps by up to 10 degrees.

- Use energy-efficient LED bulbs and fans instead of cranking the AC. A ceiling fan uses about 1/10th the energy of an AC unit.

- Turn off and unplug devices when not in use; chargers, DVD players, and cable boxes can draw phantom power.

- Heat water only as needed; set water heater to 120°F (49°C) to avoid wasting energy.

- Use vinegar and baking soda for homemade non-toxic cleaners to save on pricey products and reduce plastic waste.

- Take shorter showers and fix leaky faucets to lower water bills.

- Seal gaps around windows and doors to keep your heating and cooling inside longer.

3. Lifestyle Hacks: Save Without Feeling Deprived

- Pack lunch daily rather than buying meals out, saving around $8 per day, which adds up to nearly $200 monthly.

- Use libraries for free books, movies, and passes to events or museums—entertainment doesn’t have to be costly.

- Cut cable TV; rotating a couple of streaming services keeps costs down and content fresh.

- Host potlucks or game nights instead of expensive dining out or bars.

- Buy clothes off-season and focus on timeless basics instead of fast fashion.

- Swap services with friends like haircuts, pet sitting, or babysitting to avoid paying full price.

- Avoid single-use items like bottled water, paper towels, or disposable wipes; invest in high-quality reusables.

- Practice “no-spend” days or weekends monthly to reset habits and boost savings consciousness.

- Join local community groups for swaps, free events, or shared resources.

4. Build Strong Financial Habits

- Track spending every week to identify leaks and curb unnecessary purchases. Digital apps make this easier than ever.

- Follow the 50-30-20 budget: 50% for needs (rent, food, utilities), 30% for wants (dining out, entertainment), and 20% for savings.

- Automate savings transfers into high-yield accounts or retirement plans to make saving effortless.

- Use coupons, apps, and loyalty programs to maximize discounts without extra effort.

- Wait at least 24 hours before making non-essential purchases to prevent impulse buys.

- Pay bills early to possibly snag discounts and build strong credit history.

- Review insurance, phone, and utility plans yearly to find better deals and avoid overpaying.

- Set specific savings goals like travel, emergencies, or retirement. Goal-oriented saving increases motivation and success.

- Learn about investing basics to make your money work harder over time.

5. Home and Miscellaneous

- Vacuum carpets after sprinkling baking soda to enhance freshness and reduce need for expensive deodorizers.

- Shop groceries once a month to avoid multiple small trips, saving on impulse buys and gas.

- Use fans strategically to complement AC, reducing overall energy consumption.

- Make your own cleaning sprays using vinegar, water, and a few drops of dish soap as a natural and cheap alternative.

- Freeze leftovers to eat over several days, minimizing food waste and maximizing grocery budget.

- Consume what you already have before buying more—practice “first in, first out” in your fridge and pantry.

- Declutter regularly and sell items you no longer need online to make extra money.

The Psychological and Social Benefits of Saving Money

Beyond the obvious financial wins, saving money delivers powerful psychological perks. Studies show having financial reserves reduces stress and anxiety about the future, providing peace of mind and emotional stability—crucial in solo living when you’re your own safety net.

Goal-based savings encourage healthier spending habits and increase motivation. Saving for a vacation, a new gadget, or an emergency fund provides a sense of achievement and security. Building these habits nurtures self-esteem, reduces chances of engaging in impulsive or compulsive buying, and promotes mental well-being.

Socially, having money saved allows you to participate in activities with friends, maintain social bonds, and avoid money-related friction—leading to better overall life satisfaction.

The Impact of Financial Literacy on Savings Behavior

Research confirms that financial literacy dramatically improves savings outcomes. People with strong financial knowledge budget better, prioritize savings, and use sophisticated tools like high-yield savings accounts or investment platforms.

For solo residents, enhancing financial literacy can transform a paycheck-to-paycheck lifestyle into one of growing wealth. Education makes you aware of credit scores, compound interest, debt management, and financial scams, which are vital knowledge sets to protect and grow your money.

Public programs like the FDIC’s Money Smart have proven successful in empowering individuals to take control of their money and plan effectively.

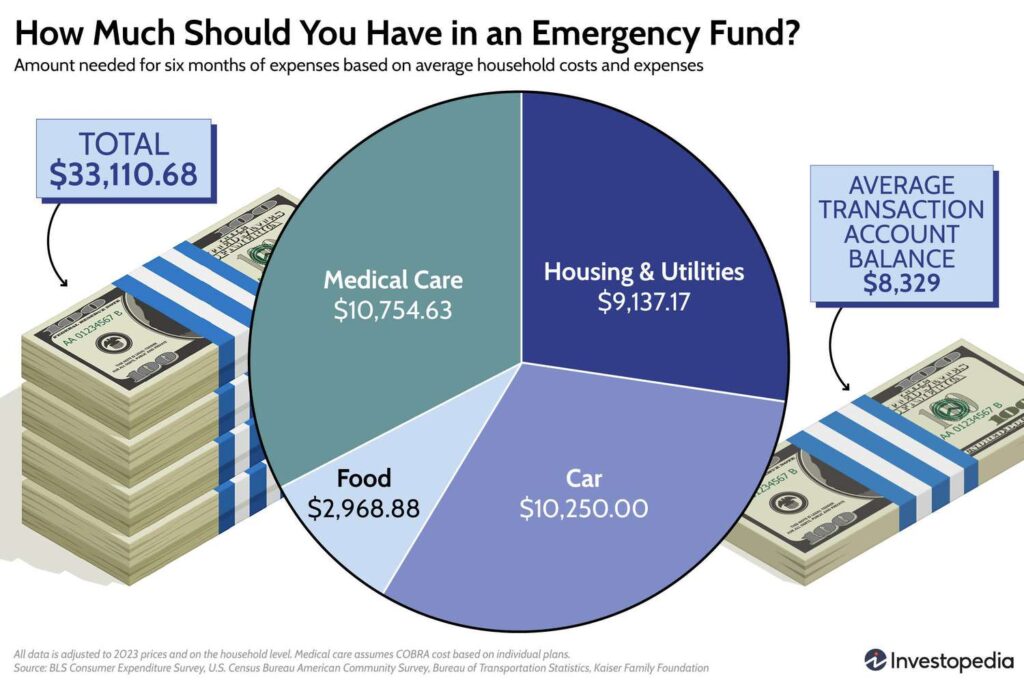

The Importance of an Emergency Fund

Nearly a quarter of Americans have no emergency savings, and 1 in 3 can’t cover a $400 surprise expense. For someone living alone, lacking an emergency fund is risky since there’s no one else to rely on for essential costs during unexpected setbacks.

An emergency fund covering 3-6 months of living expenses is your financial safety net. It reduces stress, keeps you from falling into debt, and allows you to navigate tough times without panic. Starting small—$500 or $1,000—is better than no savings at all and builds financial resilience.

Emergency funds also correlate with better health outcomes, improved work productivity, and overall life satisfaction.