Trump’s New ‘Senior Bonus’: If you’re 65 or older, you’ve probably heard some buzz about a new tax benefit called the Senior Bonus. It’s breaking news in the tax world—a game-changer that can help seniors keep more money in their pockets, grow their retirement savings, and pay less come tax season. Officially part of the 2025 One, Big, Beautiful Bill Act (OBBB), this deduction lets retirees claim an extra tax break beyond the usual ones you’re familiar with. Whether you’re relaxing with grandkids or thinking seriously about how to boost that nest egg, this senior bonus is definitely worth knowing about.

Trump’s New ‘Senior Bonus’

Trump’s new Senior Bonus deduction is reshaping retirement planning and tax savings for millions of seniors across America. By offering an additional $6,000 (or $12,000 for couples) deduction on top of existing ones, it slashes taxable income, gives more flexibility with retirement savings, and boosts financial security in your golden years. Keep an eye on your income, plan your tax moves carefully, and make the most of this temporary but powerful tax break. It’s about keeping more of your hard-earned money while enjoying retirement exactly how you want.

| Feature | Details |

|---|---|

| Bonus Amount | $6,000 for individuals, $12,000 for married couples |

| Eligibility Age | 65 or older |

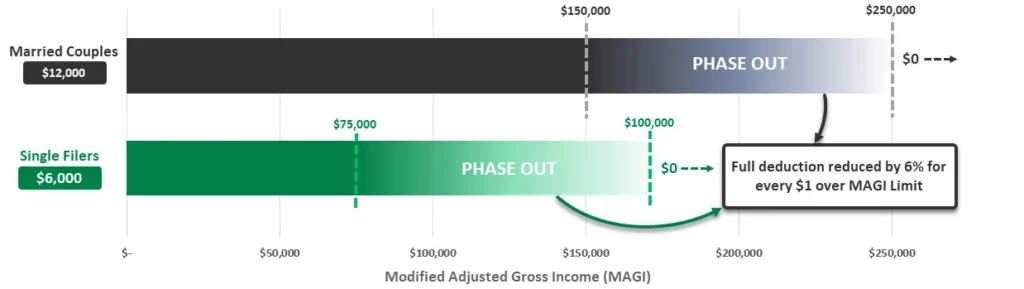

| Income Limits (MAGI) | Up to $75,000 (single), $150,000 (married filing jointly) for full deduction |

| Phase-Out Range | $75,000–$175,000 (single), $150,000–$250,000 (married filing jointly) |

| Duration | Tax years 2025 through 2028 |

| Applies to | Both itemizers and non-itemizers |

| Official Info Source | IRS One Big Beautiful Bill Provisions |

What Is Trump’s New ‘Senior Bonus’?

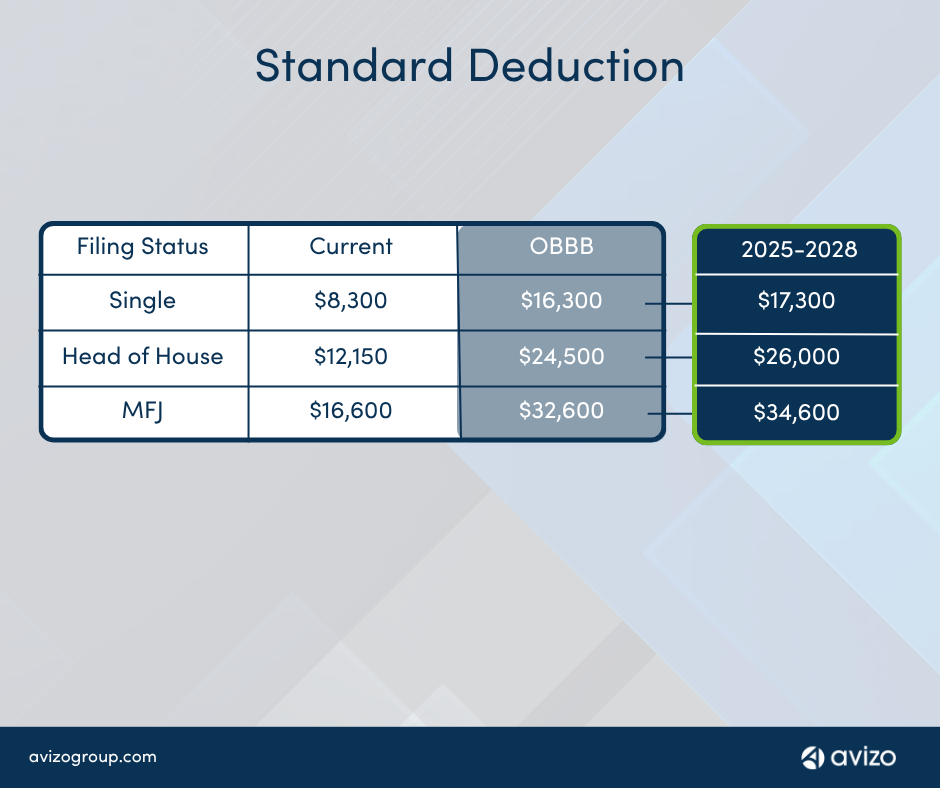

The Senior Bonus is a fresh $6,000 tax deduction for solo filers 65 and older, and $12,000 for married couples where both spouses qualify. It’s in addition to existing standard deductions for seniors and can apply whether you itemize deductions or simply take the standard deduction. This bonus is valid for tax years 2025 through 2028, so for the next few years, it’s a pretty sweet deal for seniors looking to enjoy more financial freedom.

Here’s the catch: this deduction starts to phase out once your Modified Adjusted Gross Income (MAGI) crosses $75,000 if you’re filing individually, or $150,000 if you’re married filing jointly. And if you make above $175,000 (single) or $250,000 (married), you won’t qualify for this bonus.

Breaking Down Trump’s New ‘Senior Bonus’: What It Means for You

Who Qualifies?

You’re eligible if you hit 65 years old by the end of the tax year 2025. Both single filers and married taxpayers qualify, but married couples get double the deduction—$12,000 instead of $6,000. You don’t have to itemize your deductions to enjoy this bonus either; it applies even if you take the standard deduction.

Income Limits and Phase-Out Details

The deduction fully kicks in for taxpayers with MAGI under $75,000 (single) and $150,000 (married). Once you push past those numbers, the deduction shrinks gradually until it hits zero at $175,000 for singles and $250,000 for married couples. This phased approach targets the folks who need the deduction most, making it a more equitable tax break.

How Does This Affect Your Taxes?

Imagine you’re a single retiree making $70,000 a year. In 2025, the base standard deduction for single taxpayers will be around $15,750. Seniors already get an extra deduction of $2,000. Now, you can tack on this $6,000 Senior Bonus. That means roughly $23,750 of your income could be sheltered from federal taxes—a serious drop in taxable income.

Boosting Retirement Savings

This extra deduction isn’t just about paying fewer taxes; it’s also a tool for retirement planning. Financial advisors recommend using the senior bonus to do Roth IRA conversions. These conversions let you move money from pre-tax retirement accounts into Roth accounts where future withdrawals can be tax-free. Normally, a big conversion means a big tax bill, but the senior bonus can offset that cost by lowering your taxable income in the conversion year.

What Does This Mean for Retirement Income Planning?

Retirement income streams often come from Social Security, pensions, IRAs, and savings. The Senior Bonus provides a rare opportunity to strategically lower your taxable income, so you pay less federal tax overall. By reducing income through this deduction, seniors can better manage tax brackets or delay Social Security in exchange for higher future benefits without the penalty of higher taxes now.

How Does Trump’s New ‘Senior Bonus’ Work with Social Security?

A major question on many seniors’ minds is how this new tax deduction impacts Social Security benefits, which can be taxed depending on your income. The good news? The One, Big, Beautiful Bill Act also introduces provisions that protect many seniors from paying federal income tax on their Social Security benefits.

With the addition of the Senior Bonus and other deductions, estimates show that around 88-90% of seniors may have no federal income tax on Social Security income. This means more money to spend on what matters most to you—whether that’s traveling with family, healthcare, or simply enjoying life’s little pleasures during retirement.

It’s important to remember that while Social Security benefits are often taxed if your combined income exceeds certain thresholds, the new deductions can keep you below those thresholds more easily.

How to Claim Trump’s New ‘Senior Bonus’ Deduction: Step-by-Step Guide

Step 1: Confirm Your Eligibility

Make sure you’re 65 or older by December 31 of the tax year. Also, check your income to see if you fall within the phase-out limits.

Step 2: Gather Your Tax Documents

Have your Social Security number and your spouse’s (if filing jointly) handy. The IRS requires these to verify eligibility for the deduction.

Step 3: Complete Your Tax Return

When filing Form 1040 or 1040-SR, report the Senior Bonus deduction as an additional standard deduction. Most tax software will prompt you for this automatically if you qualify.

Step 4: Keep Track of Your Income

Since the Senior Bonus phases out with income, track your MAGI carefully each year to maximize your benefit.

Step 5: Consider Retirement Account Strategies

Talk to a financial advisor about using the added deduction to do Roth conversions or other tax-saving moves.

Maximizing the Senior Bonus: Practical Tips

1. Monitor Your Income Closely

Since the deduction phases out with income, keeping your MAGI below the phase-out limit can help secure the full benefit. Consider tax-efficient withdrawals and income timing carefully.

2. Use It to Offset Roth Conversions

If you plan to convert traditional IRA funds to a Roth IRA, do it in a year when you can claim the Senior Bonus deduction to soften the tax hit.

3. Plan for the Phase-Out

If your income is near the phase-out limits, work with a tax professional to strategize your income streams so you don’t lose the deduction altogether.

4. Stay Updated on Legislation

The Senior Bonus runs through 2028 but could be extended or modified, so keep an eye on IRS updates and new bills.

5. Factor in Other Tax Credits and Deductions

Don’t forget to combine this deduction with other credits available such as the Credit for the Elderly or Disabled and health-related deductions. Coordinating these can further sweeten your tax situation.

The Bigger Picture: How This Fits Into Broader Tax Relief for Seniors

The Senior Bonus is part of the broader One, Big, Beautiful Bill Act (OBBB) aimed at delivering significant tax relief to working Americans and seniors. Another impact of the bill is that many seniors will find that nearly 90% might not pay federal taxes on their Social Security benefits, thanks in part to this deduction and other changes.

This new law permanently extends many Trump-era tax cuts, protecting smaller families from tax hikes and giving special attention to seniors. So whether it’s the increased deductions, no taxes on Social Security benefits for most, or the Senior Bonus, this bill is designed to keep more money in older Americans’ wallets.

What Are the Downsides or Considerations?

While the Senior Bonus is a fantastic opportunity, it’s important to keep a few things in mind:

- Temporary Nature: This deduction is only in place through 2028 unless Congress acts to extend it.

- Income Phase-Out: Higher-income seniors won’t benefit as much or at all.

- Not a Direct Credit: It reduces taxable income but doesn’t provide a dollar-for-dollar tax credit.

- State Taxes Vary: Some states don’t recognize this deduction, so your local tax bill might not change.