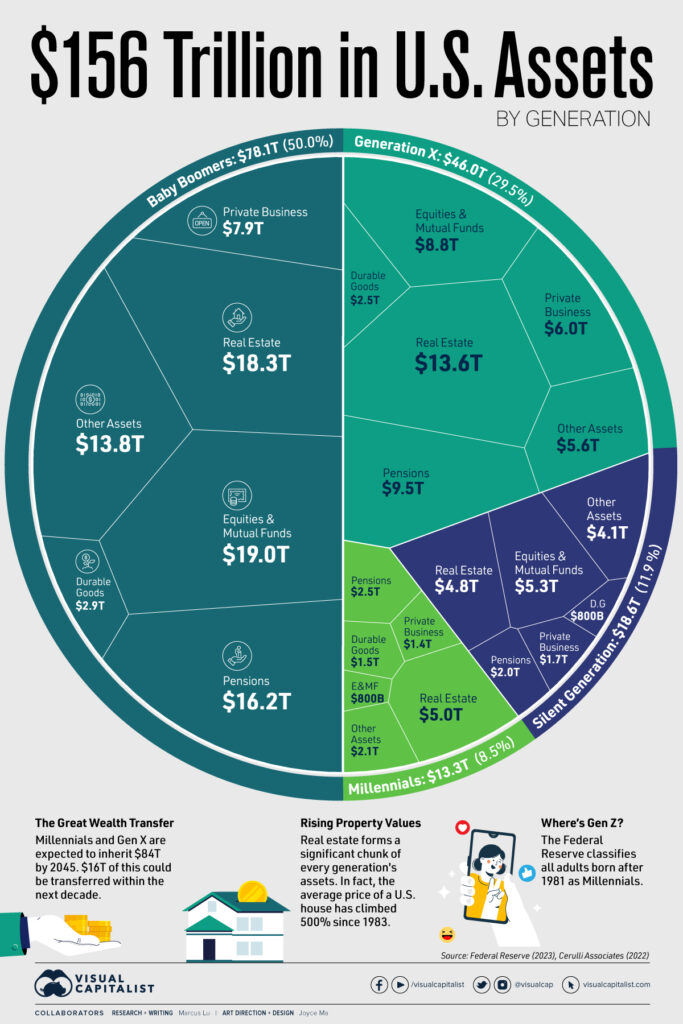

$84 Trillion Is About to Change Hands: Get ready, folks — the biggest money shuffle of our lifetime is happening right now. We’re talking about $84 trillion dollars changing hands from the Baby Boomer generation to their kids, grandkids, and future heirs over the next couple of decades. This massive shift in wealth is shaking up how families think about money, how financial advisors work, and how the economy could look in the years to come. Whether you’re a seasoned pro in finance or just curious about what this means for your future, this guide breaks down all you need to know in plain language that even a 10-year-old could get.

$84 Trillion Is About to Change Hands

The $84 trillion wealth transfer is reshaping America’s financial future. This unprecedented shift will enrich millions, disrupt markets, and redefine philanthropy. The key to success lies in open communication, smart planning, and adapting to new realities — for families, heirs, and financial professionals alike. Start the conversation today to turn potential headaches into a lasting legacy.

| Topic | Details |

|---|---|

| Total Wealth Transfer Amount | $84 trillion by 2045 |

| Wealth Going to Heirs | $72.6 trillion |

| Wealth Donated to Charities | $11.9 trillion |

| Main Generation Transferring | Baby Boomers (63%), Silent Generation (19%) |

| Percentage from HNW Families | 42% from wealthiest 1.5% of households |

| Common Wealth Transfer Tools | Grantor trusts, spousal lifetime access trusts, strategic gifting |

| Top Financial Planning Method | Family meetings and regular communication (81% of HNW practices) |

| Estate Tax Exemption (2025) | $13.99 million individual, $27.98 million married couple |

| Step-Up in Basis Tax Rule | Basis resets to market value for inherited assets, reducing capital gains tax |

| Official Reference | Cerulli Report – U.S. High-Net-Worth Markets 2021 |

What’s the Big Deal About $84 Trillion Is About to Change Hands?

Here’s the scoop: Baby Boomers, born between 1946 and 1964, represent a huge slice of America’s wealth pie — about 64% of total wealth. As they age, they’re passing on an estimated $84 trillion to the next generations by 2045. To put that in perspective, that’s nearly three times the size of the U.S. economic output (GDP) every year. This money isn’t just sitting in one place; it’s spread across homes, stocks, businesses, retirement accounts, and more.

About $72.6 trillion is expected to go directly to heirs, while roughly $11.9 trillion will be donated to charities. Nearly 42% of this wealth transfer comes from the wealthiest 1.5% of households — high-net-worth families who hold the biggest piles of cash.

This isn’t just a bunch of dollars switching hands — it’s a game-changer for families, financial planners, and anyone interested in the economy.

Why IS $84 Trillion Is About to Change Hands Such a Big Deal?

It’s a Generational Wealth Explosion

Millennials and Gen Z are about to become some of the wealthiest groups in history. We’re talking millions of new millionaires overnight, which could change consumer trends, business investments, and even politics. This wealth bump can fuel new startups, real estate purchases, and charitable foundations, setting the stage for decades of economic impact.

Risks of Losing Wealth Are Real

Family wealth can disappear fast if it’s not managed well. Historical data shows roughly 70% of inherited wealth disappears by the second generation and 90% by the third. Poor management, fights over the money, or lack of financial education are usually the culprits. That’s why financial literacy and estate planning are crucial — passing down money is more than just writing a check.

Changed Family Dynamics

Money can be a delicate subject. Families who openly communicate about their wealth and involve heirs early on in financial discussions tend to do better. Regular family meetings, education on wealth management, and proper legal planning help avoid misunderstandings and conflicts.

What About Taxes?

Taxes play a huge role in how much wealth actually passes on to heirs. As of 2025, each individual can pass up to $13.99 million tax-free to heirs during their lifetime or at death. Married couples can double that amount to about $27.98 million. Any amount above these thresholds can be subject to estate tax, which can be as high as 40%.

There’s also an important tax rule called the Step-Up in Basis. If an heir inherits assets like stocks or property, the tax cost basis resets to the market value at the time of inheritance. This means if the heir sells those assets right away, they usually don’t owe capital gains tax on the appreciation during the previous owner’s lifetime.

Good estate planning takes advantage of these laws to reduce tax burdens, often by using trusts and gifts strategically to minimize what’s taxed. Tools like grantor retained annuity trusts (GRATs) and spousal lifetime access trusts (SLATs) can be powerful when combined with annual gift tax exclusions.

Real Estate and Wealth Transfer

Real estate remains a cornerstone of family wealth transfer. Baby Boomers own about 37% of all U.S. owner-occupied homes and hold an even larger share of vacation and rental properties. Homes are often the largest asset many families own.

One strategic tool used in real estate wealth transfer is the Qualified Personal Residence Trust (QPRT). This lets owners transfer their primary or vacation home to heirs at a reduced gift tax value while retaining the right to live in the home for a specified number of years.

As this vast amount of real estate wealth filters down, younger generations’ preferences might reshape housing trends. Many heirs may prefer urban living, multi-generational homes, or eco-friendly housing due to lifestyle changes, sustainability concerns, and affordability challenges.

Philanthropy: A New Era of Giving

The wealth transfer isn’t just about family wealth—it’s also about giving back. An estimated $11.9 trillion will be directed to charities, marking a new chapter in American philanthropy.

Younger generations—Gen X, Millennials, and Gen Z—are reshaping philanthropy with:

- A focus on “giving while living”, donating during their lifetimes rather than leaving all to charity on death.

- Embracing digital and crypto donations, making charitable giving more accessible and transparent.

- Prioritizing causes that align with social justice, environmental sustainability, and innovative solutions.

- Expecting accountability and impact tracking from nonprofit organizations.

The shift in charitable giving highlights a move from traditional models toward more engaged, purpose-driven philanthropy.

Digital Transformation in Wealth Management

Millennials and Gen Z demand a new approach to managing wealth: digital, transparent, and socially responsible. Financial institutions are responding quickly by:

- Offering personalized digital platforms and apps that provide real-time portfolio views, goal tracking, and easy communication.

- Incorporating Artificial Intelligence (AI) and data analytics to tailor investment advice and automate routine tasks.

- Increasing focus on Environmental, Social, and Governance (ESG) investments as a standard offering.

- Creating hybrid advisory models blending robo-advisors with personal human guidance.

Advisors and firms that don’t embrace this digital transformation risk losing relevance as younger investors take charge of their finances.

How Families Can Prepare for $84 Trillion Is About to Change Hands: A Simple Guide

If your family is part of this historic transfer, here’s how to prepare and protect your legacy:

Step 1: Talk About Money

Open, honest conversations about finances build trust and set clear expectations. Don’t assume everyone knows the plans or values.

Step 2: Get Legal and Tax Planning Right

Wills, trusts, and tax strategies are essential. Work with estate planning professionals to customize your approach and take advantage of tax exemptions and planning tools.

Step 3: Educate the Next Generation

Teach heirs financial basics early — budgeting, investing, tax implications — so they can manage wealth wisely and confidently.

Step 4: Partner with Trusted Advisors

Find lawyers, accountants, and financial advisors who specialize in wealth transfer and who understand your family’s values, goals, and dynamics.

Step 5: Plan for Giving and Legacy

Decide how charitable giving fits in your family story and use tools like donor-advised funds to maximize tax efficiency and impact.

Step 6: Review and Update Regularly

Wealth transfer planning isn’t a one-time event. Laws change, family situations evolve, so revisit plans regularly.