5 Urgent Money Moves to Make: As the final weeks of 2025 tick away, there’s one thing savvy money folks know: the end of the year is prime time for making financial moves that set you up for success in 2026. Whether you’re a seasoned professional or just starting out, making key money moves before the calendar flips can save you thousands, grow your wealth, and set you on a path for long-lasting financial freedom. This detailed guide will break down five urgent, practical money moves you need to know, backed by expert advice and reliable data. You’ll learn exactly what to do, why it matters, and how to keep your money working smarter—not harder—in the year ahead.

5 Urgent Money Moves to Make

The end of 2025 marks your financial reset button for 2026. Taking these steps—from maxing out your tax-advantaged accounts, leveraging tax-loss harvesting, building a solid emergency fund, rebalancing your portfolio, to reviewing your budget—will put you in the driver’s seat for building lasting wealth. It’s about working smarter with your money, not harder. Start now and stride confidently into 2026 with clarity and control over your financial future.

| Key Move | Description | Important Data & Stats | Pro Tip |

|---|---|---|---|

| Max Out Tax-Advantaged Accounts | Max contributions to 401(k), IRA, and HSAs by Dec 31 to reduce taxable income. | 2025 401(k) limit: $23,500 (+ catch-up for 50+) | Capture employer match fully |

| Tax-Loss Harvesting | Sell investments at a loss to offset capital gains and lower your tax bill. | Offset up to $3,000 against ordinary income yearly | Avoid wash-sale rule window |

| Build or Replenish Emergency Fund | Save 3-6 months of expenses in liquid savings for unexpected costs. | 44% of Americans can’t cover $1,000 emergency | Automate deposits to grow fund steadily |

| Rebalance Investment Portfolio | Realign assets to maintain risk tolerance and growth potential. | Rebalancing improves returns and manages risk | Review allocation annually |

| Review Budget and Spending | Analyze 2025 spend, cut waste & budget smarter for 2026 savings goals. | Budgeting improves saving rates significantly | Use budgeting apps like Mint or YNAB |

Why These 5 Urgent Money Moves to Make Are Critical Now?

Year-end is a make-or-break moment. Tax laws get updated, financial limits reset, and deadlines close for contributions and tax deductions. Missing these cutoff dates means leaving money on the table—literally.

The IRS, financial planners, and investment experts all emphasize using this window to optimize your finances. The goal isn’t just surviving the tax bill but gaining control over your money to grow your wealth steadily. Smart year-end moves translate into less stress and a solid foundation to hit your 2026 savings, investment, and retirement goals.

1. Max Out Your Tax-Advantaged Accounts for Big Tax Savings

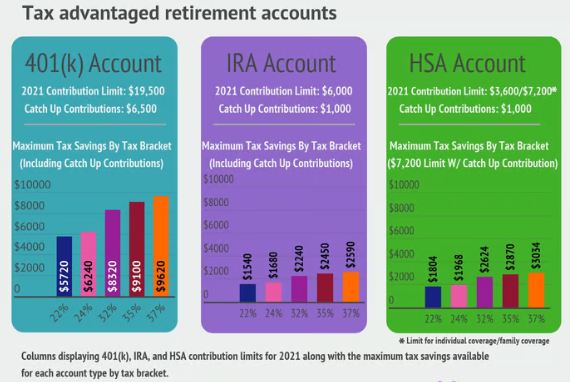

The absolute best way to save money is to contribute the maximum allowed to your retirement accounts before December 31. For 2025, the 401(k) contribution limit is $23,500, with an additional $7,500 catch-up contribution if you’re 50 or older. IRAs have a limit of $6,500 with a $1,000 catch-up.

By maxing out these accounts, you reduce your taxable income now and give your investments more time to grow tax-free or tax-deferred. Don’t forget to contribute to your Health Savings Account (HSA) if you have a qualifying high-deductible health plan. HSAs provide a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

If your employer offers 401(k) matching contributions, try to contribute enough to get 100% of that match. It’s essentially free money you don’t want to miss.

Also, consider reviewing your withholding tax to make sure you’re not giving the government an interest-free loan by overpaying.

Planning ahead? Some folks explore Roth IRA conversions, moving traditional IRA or 401(k) money into a Roth to lock in tax-free withdrawals in retirement, but this can trigger a tax bill now, so consult a tax advisor.

2. Use Tax-Loss Harvesting to Lower Your Tax Bill

Here’s a tax hack many investors overlook: tax-loss harvesting. It means selling investments that have lost value to offset capital gains from winners you’ve sold this year. If your losses exceed your gains, you can use up to $3,000 of those losses to offset ordinary income annually and carry the remainder forward to future years.

Keep in mind the IRS wash-sale rule: you need to avoid buying the same or a “substantially identical” security within 30 days before or after the sale, or you’ll lose the tax benefit.

This strategy isn’t just for the wealthy—anyone with a brokerage account can do it. Many modern robo-advisors and financial advisors offer this service automatically, making it easier than ever to employ this smart technique.

3. Build or Replenish Your Emergency Fund for Peace of Mind

Life throws curveballs—unexpected medical bills, car repairs, or job loss can happen at any time. Yet, surveys show that 44% of Americans don’t have enough cash to cover a $1,000 emergency expense.

An emergency fund with 3 to 6 months’ worth of essential living expenses in a liquid, no-penalty savings account is your safety net. If you don’t have one, start small—set a goal to save $1,000 initially, then build up.

Automate monthly transfers from your checking to your emergency fund to grow it effortlessly over time. This fund prevents going into debt or selling investments at the worst time just to cover an unexpected cost. It’s one of the simplest yet most powerful ways to safeguard your financial future.

4. Rebalance Your Investment Portfolio for Smart Risk Management

Market fluctuations can throw your asset allocation out of whack. For example, if stocks rose sharply in 2025, you may end up with a portfolio heavier on equities than planned, which increases risk. Rebalancing means selling some of your gains and buying underweighted assets like bonds or cash to restore your desired mix.

Rebalancing helps you stick to your risk tolerance, protects you in downturns, and improves long-term returns by encouraging a buy-low, sell-high discipline.

If you use a financial advisor, schedule a review before year-end. DIY investors should review their portfolio allocation at least once a year, especially before tax season and the new year.

5. Review Your Budget and Spending to Set Goals for 2026

Money management isn’t just about saving more—it’s about managing what you spend wisely. Take time now to review your 2025 expenses using budgeting apps like Mint, You Need A Budget (YNAB), or Personal Capital to track spending patterns.

Look for areas to cut back: subscriptions you no longer use, impulse buys, or costly habits like frequent dining out. Renegotiate bills such as streaming services, cell phone plans, or insurance.

With the holidays often spiking spending, December is a perfect time to reflect and plan smart budgets and savings goals for 2026. Automation can help here — set auto transfers for savings and bill payments to keep you on track without thinking about it daily.

Additional Important Money Moves to Make

Plan for a Secure Retirement

Beyond maxing out accounts, think about diversification—balancing stocks, bonds, and real estate. If you haven’t started planning for Social Security claiming strategies or Medicare, 2026 is the time. The average retiree today can expect to spend around $300,000 in out-of-pocket healthcare costs alone.

Understand 2026 Tax Changes

The IRS has increased the standard deduction for 2026 to $32,200 for married filing jointly and $16,100 for singles, slightly easing tax burdens for many. Deductions for tip income reporting and vehicle loan interest were updated, which could affect your tax filings.

Leverage Emerging Technologies and AI in Finance

From budgeting apps to robo-advisors, digital tools powered by AI are changing the way we manage money. They help personalize spending cuts, suggest better investment allocations, and automate saving strategies.

Stay Ahead with Market Trends

The U.S. stock market is expected to lead global growth in 2026 with sectors like artificial intelligence, clean energy, and healthcare innovation showing promise. Staying informed lets you align your investments with growth sectors while balancing risks.